Neuroeconomics: A Window into Human Behavior

- Published1 Oct 2012

- Reviewed1 Oct 2012

- Author Marilyn Fenichel

- Source BrainFacts/SfN

In 2008, the markets crashed, sending economies worldwide into a tailspin. While economists had noticed fluctuations in certain sectors, according to Robert Shiller, an economist from Yale University, no one actually had predicted the fall.

During the 2011 Dialogues Between Neuroscience and Society lecture, SfN’s annual presentation highlighting the ways brain research touches the human experience, Shiller turned to the language of neuroscience to discuss these events. As described in his book, Animal Spirits: How Human Behavior Drives the Economy, Shiller pointed out that economics is not just a rational endeavor. It is also driven by what John Maynard Keynes called “animal spirits” — internal drives that govern much of human behavior.

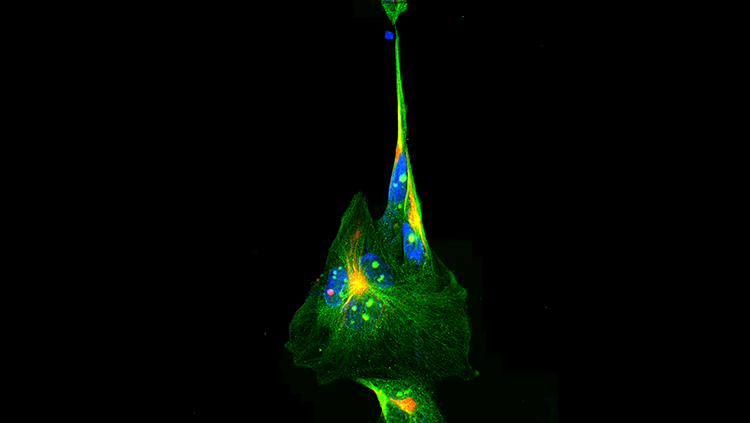

Neuroscience is starting to shed some light on the brain-based factors that affect economic behavior, sparking a subfield called neuroeconomics. The focus of this subfield is the science of individual and group decision-making. A growing body of research in neuroeconomics is helping to identify the connections between financial behavior and brain activity.

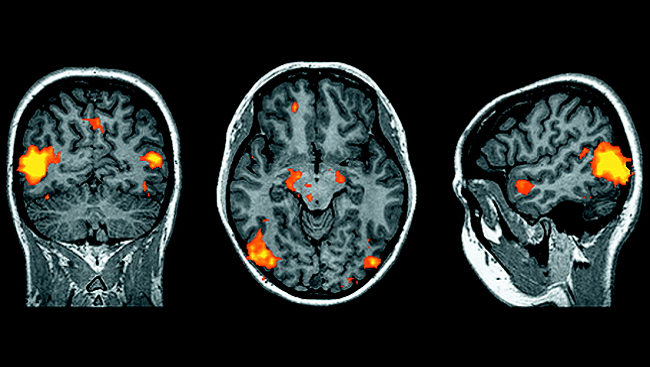

For example, Shiller described a recent study in the Journal of Economics that measured brain activity during an economic exercise. When “shareholders” were told of the possibility of an unexpected financial windfall — a special dividend — brain imaging showed a spike in neuronal activity. Yet when the shareholders received the actual reward, no response was observed. This finding suggests expectation is a driver of economic behavior. Shiller noted that when animals are presented with the possibility of a reward, they, too, will do what they need to receive it.

Research suggests another driver of economic behavior is personal outlook. The more optimistic people felt about the economy, the more likely they were to spend money and accumulate debt. As soon as confidence declined, so did the spending.

Hormones on the Trading Floor

What can neuroeconomics tell us about the decisions stock traders make as they move in to close a deal? During a small study conducted at the University of Cambridge, Shiller explained, researchers measured the hormone levels of 17 young male traders to see how they corresponded to behavior. Specifically, the researchers looked at testosterone, the male sex hormone linked to aggression, and cortisol, a hormone secreted during stress. Their findings provided a glimpse of the relationship between physiological responses and financial actions.

The hypothesis guiding the study was that the higher a trader’s testosterone levels were at the beginning of the day, the more money he would make. Similarly, the researchers believed cortisol levels would rise if the day’s trading resulted in above-average losses.

The results of the study did show a positive correlation between testosterone and profits. Cortisol, however, rose not in the face of actual losses but in anticipation of market volatility and the prospect of increased profits. Researchers believe that for a period of time, elevated cortisol can result in increased motivation and focus.

Sometimes, however, there can be too much of a good thing. The study suggests that if both testosterone and cortisol levels remain high, the two hormones could work in opposition to each other, with testosterone promoting risk-taking and cortisol leading to risk-averse behavior. Receiving these conflicting signals may make it difficult for traders to conduct sound risk assessments.

Linking Behavior to the Economy

Clearly, such behaviors can have an impact on the world economy. The question, however, is how much of an impact. Dialogues panelists Wolfram Schultz, a neuroscientist from the University of Cambridge, and Antonio Rangel, a neuroeconomist from the California Institute of Technology, had a lively discussion about this issue, with Shiller and SfN President Susan Amara pointing out a couple of possible scenarios.

Schultz suggested that perhaps a relatively small number of people made the risky decisions that led to the crash, and others followed suit because of herding behavior. Alternatively, Rangel speculated that an aggregate of individual decisions moves the system along, resulting in booms and busts.

At this point, whether the economy is driven by one — or both — of these scenarios is unclear. “We can’t conduct controlled experiments in economics,” concluded Shiller. “No government in the world would let us raise interest rates in one country and compare its behavior to countries with lower rates. Therefore, what’s called for now is more research about individual decision-making and how individuals interact in the economic arena,” he said.

CONTENT PROVIDED BY

BrainFacts/SfN

Also In Archives

Trending

Popular articles on BrainFacts.org